Leave a Comment:

(0) comments

Add Your Reply

Continuing with the NPR tale on the Federal Reserve’s 100th anniversary, when we last left off, JP Morgan had rescued America from the panic of 1907. But according to the story, having J.P. Morgan in charge is a precipitous situation. For who, however, is an important unanswered question here. Nevertheless, the NPR yarn continues:

Goldstein: One very powerful guy in particular decides this [JP Morgan in charge] is a problem – Senator Nelson Aldrich, Republican from Rhode Island. Aldrich knows there’s something America can do so that it will no longer have to rely on one guy [J.P. Morgan] when these panics happen. The U.S. can create a central bank.

Smith: And this isn’t a new invention. Countries in Europe already had central banks. And during panics they basically did what J.P. Morgan did; they acted as a lender of last resort for healthy banks. So if you’re a bank and you’re basically sound, you can go to the central bank when depositors are lined up out the door yelling for money.

Goldstein: But just consider that name, central bank. Throughout American history, both of those words, central and bank, have been deeply unpopular. The thought of a bunch of rich bankers in New York City controlling the economy did not inspire confidence.

Smith: Still, Aldrich worried that the only people who could actually help design a central bank were rich bankers in New York City. They knew that was not going to look good. So in 1910, Nelson Aldrich comes up with a plan.

After the crash, Theodore Roosevelt and Congress created the National Monetary Commission. The purpose of the commission was to study the banking problem and create a report for Congress.

The committee was packed with J.P. Morgan’s allies.

For example, the Chairman was Senator Nelson Aldrich from Rhode Island. Rhode Island was the location of homes of America’s wealthiest families.

Aldrich was a business associate of J.P. Morgan with extensive holdings in banking. His daughter married John D. Rockefeller Jr. Together they had five sons:

After the National Monetary Commission was set up, Senator Nelson Aldrich embarked on a two-year tour to Europe, where he consulted in length with the private central bankers in England, France and Germany. The total cost of his trip was $300,000 USD, a considerable amount of money in those days.

Goldstein: We’re standing here at the Hoboken Train Station in Hoboken, New Jersey, and we’re here because this place or someplace right near here was key to Aldrich’s plan.

He told some of the most powerful bankers in the country, I want you to gather at the train station. He told these bankers do not travel together, come alone.

And most importantly, don’t come here in your top hat and your monocle looking like a million bucks. They came here dressed as duck hunters.

They were told that when they got here, they would find Aldrich’s private rail car attached to the back of a southbound train.

The car itself was bound for Georgia because they were going to meet in a private club on an island off the coast of Georgia, a private club, by the way, that J.P. Morgan used to be a member of. The name of that private club, the name of the island? Jekyll Island.

Smith: Apparently the name Jekyll Island didn’t seem quite so sinister back in 1910. The bankers at Jekyll Island knew Americans thought a central bank could become too powerful, too influential in the economy, too much like J.P. Morgan.

So they came up with a classic American workaround. The U.S. is not going to have one central bank in New York. It’s going to have lots of little central banks scattered all around the country.

Now, the plan they came up with still had a long way to go. It was shot down the first time in Congress, got tweaked, debated, rewritten, but the basic idea they came up with at Jekyll Island held up.

And 100 years ago today, President Woodrow Wilson signed the Federal Reserve Act into law. (end of excerpt)

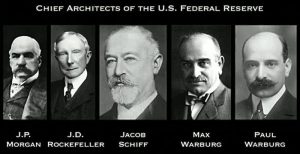

Leading the group which met on Jekyll Island was Paul Warburg– the Daddy Warbucks character of Annie.

Warburg had been given a $500,000 annual salary to lobby for the passage of a privately owned central bank in America by the investment firm, Kuhn, Lobe and Co.

Warburg’s partner in this firm was a man named Jacob Schiff, the grandson of the man who shared the green shield house with the Rothschild family in Frankfurt, Germany.

Schiff was in the process of spending $20 million dollars to finance the overthrow of the Czar of Russia.

These three European banking families, the Rothschild’s, the Warburg’s and the Schiff’s, were interconnected in marriage down through the years, just as their American banking counterparts, the Morgan’s, Rockefeller’s and Aldrich’s were.

Secrecy was so tight that all seven primary participants were cautioned to use only first names, to prevent servants from learning their identities.

Years later one participant, Frank Vanderlip the president of National City Bank of New York, and a representative of the Rockefeller family confirmed the Jekyll Island trip in a February 9th addition of the Saturday Evening Post:

I was as secretive – indeed, as furtive as any conspirator. Discovery, we knew, simply must not happen, or else all our time and effort would be wasted. If it were to be exposed that our particular group had got together and written a bank bill, that bill would have no chance whatever of passage by Congress.

The participants had gone to Jekyll Island to solve one problem, and that problem was, how to bring back a privately owned central bank. But there were other problems that needed to be addressed as well.

The first problem they had was that the market share of the big national banks was shrinking fast. In the first ten years of the century, the number of national banks had doubled to over 20,000.

By 1913, only 29% of all banks were national banks. Those nationals held 57% of all deposits. This made the big banks a minority of sorts in their eyes. They wanted control of all of it.

Senator Aldrich would later admit in a magazine article:

Before the passage of this Act, the New York Bankers could only dominate the reserves of New York. Now, we are able to dominate the bank reserves of the entire country.

In the mind of the plotting bankers, something had to be done to bring these new banks under their control.

Corporations were so strong that they were beginning to finance their expansions out of their own profits, in place of taking out huge loans from large banks.

In the first ten years of the new century, 70% of corporate spending came from profits.

In other words, American industry was becoming independent of the money changers. That trend had to be stopped. And stopped it was. You’ll see how.

After the first bill of the Jekyll Island plan was introduced, the bankers saw that they didn’t have enough congressional votes to have the “Aldrich Bill” passed. Therefore, the bill was never brought to a vote- a practice still used today when a vote is not assured.

The problem was that the Aldrich name was associated with wealth and big banks. Not a good look if they wanted this plan approved because constituents would pressure their elected representatives not to adopt it.

The bankers were not defeated however.

They decided to move toward financing a new effort, placing a man who was sympathetic to the bankers in the highest office of government. That man, who we mentioned in part one, was Woodrow Wilson.

Woodrow Wilson was hand-picked to become the Democratic nominee. Wall Street financier Bernard Baruch was put in charge of Wilson’s education. Historian James Perloff, author of Shadows of Power notes:

Baruch brought Wilson to the Democratic Party Headquarters in New York in 1912, leading him like one would lead a poodle on a string. Wilson received an indoctrination course from the leaders convened there.

Wilson won the election. Now, the stage was set. The international financiers were now poised to install their privately owned central bank once again.

Opponents of the banking monopoly were led by William Jennings Bryan. The opponents of the money changers, ignorant of Baruch’s tutelage, now threw themselves behind the Democratic representative Woodrow Wilson. The Americans and Bryan would soon be betrayed.

During the Democratic campaign, the supporters of Woodrow Wilson “appeared” to oppose the Aldrich Bill. The appearance was the illusion.

As Rep. Louis McFadden, a democrat and chairman of the House of Banking and Currency Committee explained it twenty years after the fact:

The Aldrich Bill was condemned in the platform, when Woodrow Wilson was nominated, the men who ruled the Democratic Party promised the people that if they were returned to power there would be no central bank established here while they held the reins of government.

Thirteen months later that promise was broken, and the Wilson administration, under the tutelage of those sinister Wall Street figures who stood behind Colonel House, established here in our free country the worm-eaten institution of the “king’s bank” to control us from the top downward and to shackle us from the cradle to the grave.

Once Wilson was elected- Morgan, Warburg, Baruch and other bankers hatched a new plan. They would rename the plan, inspired by Warburg’s suggestion, the Federal Reserve System.

The Democratic leadership then selected a new name for basically the same plan as the Aldrich bill. It was now hailed as a new bill known as the Glass-Owen Bill.

This “new bill” was sold to the public and unsuspecting Congressional representatives as something radically different from the Aldrich Bill. In fact, the bill was virtually identical in every important detail.

The Democrats were so convincing in their denial of the similarities of the bill that Warburg (the architect of both bills) had to step in and reassure his paid friends in Congress that the two bills were in fact identical:

Brushing aside the external differences affecting the shells, we find the kernels of the two systems very closely resembling and related to one another.

However, Warburg’s admission was for private consumption only.

Publicly the money trust used Aldrich and Frank Vanderlip, the president of Rockefeller’s National City Bank of New York, and one of the Jekyll island seven secret conspirators, to oppose the new federal reserve system. This was another part of the ruse to convince the unsuspecting public and Congress that this was not a bill representing big money.

Kind of like Br’er Rabbit telling Br’er Fox not to throw him into that briar patch no matter what he did. And Congress, as well as the public, bought into this ruse hook, line and sinker at a very costly future price unbeknownst to them.

What the CDC Would Rather You Not Know About COVID Tests, Categories, and Their Numbers

Draining the Swamp- Trump Signs Executive Orders Aimed at the Federal Employee Sector

Obama Budget Deceptions- Reality Before the State of the Union Deception (Uh, I mean Address)

NBA Commissioner Stern Dead at 77 – Globalist Elite Saddened

Who Are the Syrian White Helmets? As Heroic As the Leftstream Media Claims?

The “Too Big to Fail” Banks are Getting Openly Bolder in Asserting Their Control Over Our Lives

Congress Funds Government with More Funny Money- Banks Get Free Bailout Pass in Return

Some Final Thoughts on the Guns and Ammo Article- Part 3