Leave a Comment:

(0) comments

Add Your Reply

By Terry | Donald Trump

In 2016, before Trump was elected, sources reported that premiums on mid-level Obamacare health plans would rise on average 25% the next year. ABC reported:

Overall, it’s shaping up to be the most difficult sign-up season since HealthCare.gov launched in 2013 and the computer system froze up.

Enrollment has been lower than initially projected, and insurers say patients turned out to be sicker than expected. Moreover, a complex internal system to help stabilize premiums has not worked as hoped for.

Nonetheless, Obama says the underlying structure of the law is sound, and current problems are only “growing pains.” The president has called for a government-sponsored “public option” insurance plan to compete with private companies.

Republicans, including Trump, are united in calling for complete repeal, but they have not spelled out how they would address the problems of the uninsured.

Clinton has proposed an array of fixes, including sweetening the law’s subsidies and allowing more people to qualify for financial assistance.

Keep in mind that 25% was the average. In Arizona it was 116%. In Pennsylvania, it was 43%. North Carolina- 40%

Minnesota was considering calling for a special session to generate special funding to deal with the increase for citizens in its state.

However, more importantly, the cumulative rise in premiums since Obamacare began three years prior had been a whopping 126%.

When the plan was initiated, it was projected that at least 21 million sign ups were needed to make Obamacare work. By 2016, only 12 million had enrolled. For reasons cited below, most of those were high claims cases as well.

When Obama, along with Nancy Pelosi and Harry Reid et all were selling the Affordable Care Plan to America, the promise was that “We will start by reducing premiums by $2,500.” So what actually happened?

Since Obamacare began the average family (the middle class) by 2016 was paying $4,100 more for their health insurance. That was, a $6,500 increase over Obama’s promise. No wonder he campaigned for Hillary. They were two peas in a moral pod. Subject to hyperbole and well…..downright lying.

Any plan that eliminates underwriting risks, as Obamacare had with its elimination of screening based on pre-existing conditions, is destined to collapse under its own weight.

This feature alone creates a fatal flaw that will drive it to failure. Either premiums will rise to the point of becoming unaffordable, and/or benefits will be cut to point of making the coverage hardly worth the cost. Both usually happen at the same time.

As we continuing to witness with Obamacare, insurers will simply abandon the plan as 1.4 million people in 32 states discovered.

Large insurers like Aetna, Humana and the United Healthcare Group left the exchanges by simply terminating their plans……..because they are losing too much money. This is the “choice” that Obamacare produced for consumers- less competition.

Despite subsidies by the government, in fact actually paid for by the public,Obamacare premiums continued to rise significantly.

So what is the predictable response of Statists like Obama and Hillary and the socialist loving Democrats?

No admission of failure of direction or flaws in the basic concept. Instead, they propose more government control and more public money be thrown at the problem which their model actually created.

In short, their solutions will be like using gasoline to put a fire out, simply because it is a liquid.

Any plan that eliminates underwriting. such as Obamacare has done, creates a fatal flaw that will doom it to failure.

There is a reason that people are able to earn a living as actuaries and underwriters. They are a key component of the business of insurance in keeping it stable and profitable.

Without their work, insurance is little more than legalized gambling or a game of Russian roulette with a bullet in the chamber. Eventually, the chamber will spin to the bullet and then its BAM! You lose. Rates rise at uncontrollable levels or the benefits you once enjoyed simply disappear. Usually both at the same time.

Underwriting helps make insurance affordable and here’s how.

All of the insureds pay their premiums to the company to create a pool of money.

Most people believe insurance works like this. They pay the insurance company. The insurance company earns its profits from the premiums. When they raise the premiums, it is because they are greedy and want more profit.

I sold health insurance and shared that misconception. I was surprised to find out that I was wrong. My brother straightened me out.

My brother ran the AARP plan for Prudential. At the time, I sold health insurance to small businesses along with other types of insurance and investments.

At the time, insurance plans were rated based on claims experience. Even so, I could sell a policy with a $200 annual deductible, 20% co-pay up to a maximum of $2000 with unlimited coverage and your choice of hospital or doctor for about $200.00 a month for a family.

However, things changed. Socialized, government run medical care entered the picture in the form of Medicare and Medicaid. As a result, insurance premiums began to sky rocket.

Normally, losses in a market tell you something about how well any changes have actually worked. With socialists, power is more important than results. So, they don’t pay attention to silly things like profits and losses.

Eliminating risk underwriting has not helped premiums. This is why.

At the time of my discussion with my brother, we were both in the health insurance business. Myself as a sales person. I knew that premiums on older insureds with higher claims experiences were pretty high because I priced plans from a retail point of view. When there were a lot of older employees, the premiums were naturally higher.

So, I asked him as a plan administrator of AARP:

How can Prudential afford to insure all those people on the AARP plan? Won’t the rise in rates cause them to lose too much money?

He responded by asking me, “Well, who pays the premiums?”

I replied, “The insurance company.”

He said, “No, they don’t.”

A bit surprised at his answer because after all, I sold a lot of health insurance plans to small businesses. I knew better, so I thought. I challenged him and asked, “Well, then who does?”

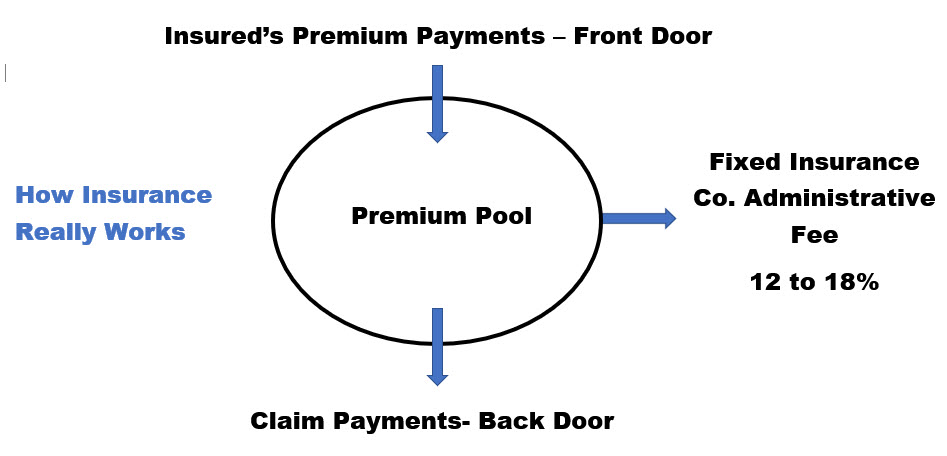

He explained to me that insurance (That’s all insurance btw.) is a shared pool of risk. Into the front door comes all of the premiums which fill up the shared pool.

However, out of the back door from the shared pool goes the payments for all of the claims.

Out of the side door goes the insurance company’s administrative charge. The insurance company earns its profits by attaching a fixed administrative charge. That doesn’t change. Their profits come from the administrative fees, not the premiums.

At the time my brother administrated the AARP program, Prudential managed their plan because they came in with the most competitive percentage on the fixed admin fee.

When that changed, which it did eventually, Prudential lost the AARP coverage to another carrier with a lower admin fee. The plan remained, the insurer changed. Common in fixed group models like an AARP plan. The administrator can change, but the plan remains in place.

Remember, the premiums coming in the front door fill the pool. The claims going out the back door drain it.

So, if the pool gets too shallow from high claims expenses, you have to fill it back up with more premiums. Where do the premiums come from? Well, as already noted, they come in the front door from the insureds.

The insurance company doesn’t fill up the premium pool to increase their profits. They fill it up to pay the claims.

They earn their profits from the fixed administrative charge. Efficiency and reduced claims costs advance their profits, not premiums.

So, the answer as to who pays the premiums in a health insurance policy is quite simple: the insureds do.

More claims? Simple fix. The people who are insured pay more.

In the case of a government plan, we all end up paying because government simply fills up the pool with more money from the public taxes or from the Federal Reserve, money from nothing system. All of which gets added to the public debt.

In other words, we all pay in one way or another!

As previously noted, if the claims in the pool rise, the people in the pool will pay higher premiums to fill it back up.

In the case of Obamacare, we all will eventually pay from the increased national debt if it continues as we will with Medicare and Medicaid as well.

Growth in debt means more money is needed to pay it off. This, in turn, inflates the value of the dollar. When a currency inflates it reduces its purchasing power which means meaning you can buy less with the money you earn. It also reduces your ability to save or invest as well.

In a true free market, the insurance company doesn’t want higher premiums. When premiums grow, healthy people in a competitive free market, who can afford to pay, leave the plan for a lower cost plan. In other words, the insurance company will lose customers in a competitive free market because customers vote with their dollars in a free marketplace.

Sick people stay because they are benefiting the most from the plan. They cannot afford to leave and lose coverage. Unless you have NO underwriting which means the insurance company has no way to underwrite and assess the risks they add to the shared, premium-created pool of money.

However, when rates rise, the people who can leave the plan will. They are very “insurable” and will be able to find more affordable coverage elsewhere.

What you just read is the primary reason rates will rise in a health insurance plan. Less people are adding premiums to the pool which lowers the total premiums in the pool. Healthy people along with their premiums have left.

However, since the sicker people cannot leave, more claims are going out the back door because the sickest people remain in the plan.

Kinda works like this: Less people + More costs = Higher Insurance Premiums

In health insurance, underwriting allows the insurer to assess their risks. As a member of an insurance pool, you want them to assess their risks carefully. The better their risk predictions, the lower premiums you will pay because claims will be moderate.

If the underwriters assess risks poorly and take on a lot of bad risks, you will pay higher premiums because claims costs will rise.

Dividing people into classes based on their sex and age actually helps premium payments.

Younger healthier single people will pay lower premiums. Lower premiums for them will attract more of them into the plan. Their premiums and their lower claims will help offset some of the costs for the older and sicker people who will pay higher premiums.

Woman of child bearing age also may pay higher premiums because it costs more money to have a baby.

Single females and males alike with lower claims offset some of that rise for that class too.

There is a balance that works itself out if all is done intelligently and carefully. Never perfect but better than no underwriting or risk assessment at all as government plans all over the planet demonstrate.

Now however, much of that has been discarded. People think that premiums are going up because insurance companies are making money off of them. They aren’t.

As mentioned above, insurance companies make their money from the fixed administrative charge, not the total premium. If claims rise, premiums will also.

As should be clear by now, this is because the insureds pay the premiums, NOT the insurance company.

The bottom line: reducing underwriting of risks will generate higher premiums. The shared pool becomes a gamble or a crap shoot based on chance, not a skilled assessment of risk.

This is how I knew from my brother’s impromptu class that Obamacare is destined to fail. It will collapse under the weight of its own crap shoot arrangement.

That is also why I knew that Obamacare is more about control of the people. It was never intended to be a genuine solution. This is why the law is so large and covers much more than health insurance. It controls the people from cradle to grave. Costs are a secondary factor. With all government plans control of the people is the real intent- not profit.

When you eliminate underwriting, which means take out the ability to reject a person as a poor risk because of pre-existing conditions, or even the risks associated with their class of insureds (such as age, sex and even occupation), insurance necessarily attracts the highest risks.

Those people who can benefit the most from it (people already sick) by having their penalty of higher premium to enter the pool eliminated will grab it because they have no other good choice.

By paying much less than they would if they paid for their already existing treatment for a pre-existing condition like diabetes, heart disease, cancer even pregnancy, they get more benefit for the money.

treatment for a pre-existing condition like diabetes, heart disease, cancer even pregnancy, they get more benefit for the money.

The healthy people in the plan, who may in fact even take better care of themselves, end up paying more money for the increased number of sick people now in the plan. Kind of like paying public school taxes when you have no children in school.

This may sound heartless, but those are the facts. Increased claims cause premiums to rise.

The more sick people that enter a plan or even get sick while in a plan, the higher the premiums will rise because higher claims leaking out the back door will drain the pool requiring more premiums from insureds already in the pool.

Hillary however didn’t acknowledge the above connection. During the second debate Hillary said,

But here’s what I don’t want people to forget when we’re talking about reining in the costs, which has to be the highest priority of the next president, when the Affordable Care Act passed, it wasn’t just that 20 million got insurance who didn’t have it before. [Note: Actually 12 million but hey it was Hillary speaking.] But that in and of itself was a good thing.

But everybody else, the 170 million of us who get health insurance through our employees got big benefits.

Number one, insurance companies can’t deny you coverage because of a pre-existing condition.

Now that you know a bit about how insurance is designed as a shared risk pool, can you see the disconnect?

In short, like most leftists and politicians in general- she didn’t know what she was talking about! She simply did not understand how insurance really works in real life.

Or worse, she did, but didn’t admit it publicly because she wasn’t really interested in the cost but rather- the control. More important to her than what happened to costs was who controlled the people by controlling the coverage. The socialist Dems all still have that scenario in mind, even if they won’t openly admit it or are so dumbed down they simply don’t see it.

After all, it was Lenin who was reported to say that “Health Care is the Keystone to Socialism.”

Hillary also stated at the time that:

Well, I think Donald was about to say he’s going to solve it by repealing it and getting rid of the Affordable Care Act.

And I’m going to fix it, because I agree with you. Premiums have gotten too high. Co pays, deductibles, prescription drug costs, and I’ve laid out a series of actions that we can take to try to get those costs down.

How was she going to “fix it” when she claimed that one of its biggest benefits of Obamacare is that it eliminates the pre-existing condition underwriting?

She wouldn’t. The plan was and still is destined to fail.

The elimination of risk assessment by guaranteeing coverage regardless of current health will continue to attract the sickest people who need it the most just as the opening ABC admitted above.

Hillary or any politicians fix will be like the “fix” we are seeing now. Higher premiums and declining quality.

Before government entered into the health care marketplace, we had some of the best health care in the world. Underwriting was able to operate freely as it does in other markets like car insurance. Bad driving records get you rejected by an insurance company or you pay higher rates. It both rewards and forces people to drive more carefully.

Health insurance could do the same. That is, fear of high rates would encourage people to take care of themselves. It helps them and the pool of other insureds. It helps the insurance company remain in the business of providing you coverage in the event that life steps in the way and your health conditions suddenly change.

Once Medicare and Medicaid, socialist programs the both of them, began in earnest, everyone was covered once they reached a certain age or had a certain income. Healthcare premiums began to rise steadily shortly thereafter.

It has continued ever since. (P.S.- There is no Constitutional authority to take control over a private market btw in case you were wondering.)

The government and Statists will never admit that but as a seller of health insurance delivering increases of 80% and more, I watched it first hand after Medicare got going in earnest.

The game, as renewals rolled in, to retain the business became to offer alternative plans at lower cost. Then in a year or two, they went up too. The game of shop and switch went on once again. It was stressful for not only the agent and the business owner but also the insured as plan benefits went down with higher deductibles and co-pays but costs also went up.

Small and large businesses were forced to spend inordinate time on shopping for affordable health care.

The problem was created by government control of a free market. Government caused costs to rise by eliminating the very things that helped keep them affordable such as underwriting which was eliminated through guaranteed coverage regardless of your current state of health.

Obamacare made it worse by forcing people to have coverage. Insurers were guaranteed a customer base by the force of law. Fortunately, that has been eliminated.

There is much more work to be done. Currently, drug companies can raise costs and know that they will have customers anyway because of the Bush drug plan. (Just like government subsidized college education btw.)

Obamacare is and was a predictable disaster designed to get worse. Rather than repeal and replace that Trump is touting, it should be repeal and allow. That is, allow the free market to operate and let customers vote with their dollars.

Keeping government involved in a market they have never had a Constitutional authority to be involved in is and always was a mistake. We either end government involvement or watch the medical care market continue to fall apart before our eyes. It can not be “fixed” by government any more than any market government involves itself in.

Unfortunately, for now, we’ll just have to watch and see.

Typhus Carrying Rats in LA Among the Piles of Trash Shows That “Progressivism” Apparently Leads to Progressive Decline

Tucker Carlson Reports on Impact of Illegals on Tijuana and Environment- Lies Cry the Left!

This Criminal Reform Bill Trump is Endorsing……I Just Don’t Get it.

MS13 and Other Criminals Sneaking Across Border- Embedded in Family Units of Illegals

The Recent Market Corrections Point to Our Achilles Heel – Massive Debt

Planned Parenthood President, Cecile Richards Proudly Resigns. What is She So Proud Of?

Do Black Lives Really Matter to Black Lives Matter? The Evidence Suggests Otherwise.

2016 Presidential Election- Lopsided Bias Concentrating on Dirt Not Real Issues.