Leave a Comment:

(0) comments

Add Your Reply

By Terry | Bernie Sanders

Socialists are always quick to spend other people’s money. Bernie sure is ready willing and able to, as long as its someone else’s. Of course, he has a sound byte solution for our Socialist Security system- expand it!

Smiling Bernie’s proposition sounds like such a simple and effective solution, doesn’t it? Lift the cap and expand it. But let’s go beyond the simplicity of yet another campaign promise and probe a bit deeper.

“We should be expanding Social Security.” Words Bernie knows the public wants to hear.

Easy to say, but somehow there are some facts left out of that easy solution.

There is no mention of the fact that we are now $23.3 Trillion in debt or over $72,000 per man, woman, and child.

We need to be focused on ways to reduce that debt, not ways to increase it. Otherwise, the economy will simply collapse into hyperinflationary destruction of the currency. That may even wipe the smile off Bernie’s often angry face.

Additionally, the Social Security Trustees have already told us that Social Security is running out of money. Baby boomers are retiring in droves now which will continue to grow. This is going to put an additional financial strain on both Social Security and Medicare which make up 48% of our national budget already.

Of course, these realities are never mentioned by those courting the vote during campaigns. Facts tend to get in the way of campaign promises.

This excerpt is from the Social Security Trustees Report Summary of 2018 itself:

Social Security’s total cost is projected to exceed its total income (including interest) in 2020 for the first time since 1982, and to remain higher throughout the remainder of the projection period.

Social Security’s cost will be financed with a combination of non-interest income, interest income, and net redemptions of trust fund asset reserves from the General Fund of the Treasury until 2035 when the OASDI reserves will become depleted.

So that now we have a little background on the present realities of Social Security:

In an article entitled Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much By Rachel Greszler of the Heritage Foundation, she acknowledges first of all that Social Security (nearly 24% of our Federal budget alone) is insolvent and demands immediate reform. Ok, at least she acknowledges the realities of the program.

She also notes that the present cap of $117,000 covers 83% of all wages and 94% of all workers. Keep in mind that while the cap does not take any income from those above it, it also provides no benefit to those above it either.

In other words, they provide their own retirement which is what they were expected to do when the cap was established by the socialist-oriented Roosevelt Congress.

Additionally, our cap is already significantly larger than the tax cap of all other industrialized nations at 2.5 times the average wage compared to 2 times in Germany, 1.5 in Japan and 1.2 in the U.K. with Canada equal to the average wage.

[youtube_advanced url=”www.youtube.com/watch?v=JNFvSHv1R4A” controls=”no” rel=”no” theme=”light”]

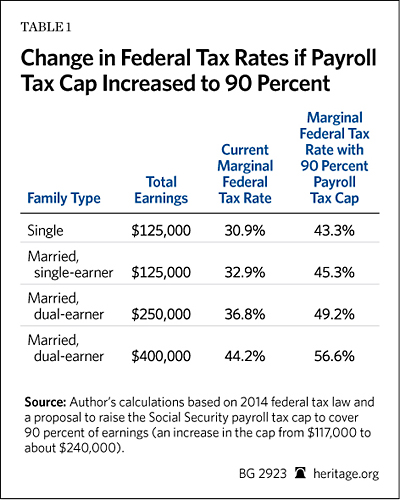

Raise the cap to cover even 90% of earnings and a single person with $125,000 in earnings would see a combined federal income and payroll tax rate jump from 30.9% to 43.3%. Married couples with 2 children would rise from 36.8% to 49.2% or in more simple terms, they would pay $2,800 more in taxes.

Earn even more and it gets even worse. The marginal tax rate for a married couple with 2 children earning over $400,000 in earnings would rise from 44.2% to 56.6% with a tax liability increase of as much as $35,500!

Essentially, what Bernie’s solution amounts to is nothing more than a penalty for economic success and an incentive to strive for mediocrity which is one of the ways socialist schemes collapse productivity.

You see, there is a very basic reality that most of us fall prey to. Human beings want to do the least amount of work for the greatest amount of benefit.

Make it easy for them not to work and still survive at a reasonable level and guess what? They will stop being productive citizens.

Why work for something when you can get close to the same thing for nothing? Do some studies of socialist economies and you will find that is what is happening.

Multiple government studies also show that increased Social Security surpluses have not helped the system but rather have contributed to more government spending.

Historically in all governments, the surplus from Social Security has served as a way of financing other forms of government spending. Actually, the tune of over $1 Trillion in our nation since the inception of Social Security.

A paper on this issue in 2004 suggested that when the crisis occurs in 2017 “when payroll tax receipts are insufficient to finance benefits”. Actually, the crisis started in 2010 suggesting that we may have less time than we think to resolve this issue since government spending has increased quite markedly under Obama.

Suppose we eliminated the cap entirely as Sanders suggests? Would that resolve the issue? According to the SS Administration:

Even if the tax cap were eliminated completely and no new benefits were credited to those who pay higher taxes (fundamentally altering the contributory nature of Social Security), this massive tax increase would still fall $2 trillion short of eliminating Social Security’s estimated 75-year actuarial deficit.

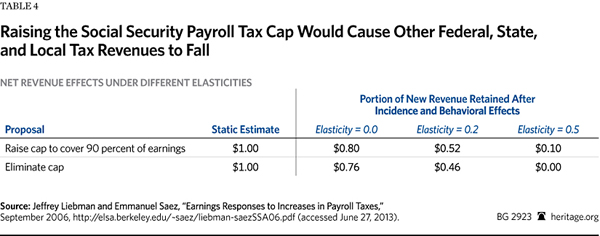

But as the Heritage paper points out, these figures represent static revenue projections.

The reality is that employers will reduce employee wages which will reduce the revenue projections and likely speed up the deficit building date to a much earlier one than the static projections.

Now, the numbers get a little too much to place here (See the paper for details and references.) but essentially changing the cap would cause a reduction in the workforce that would cause a loss in revenue from reduced employee wages and employees choosing to work less. A 90% cap increase would end up with a net gain of only 52 cents per dollar since there would be a 48% reduction due to the changed employer-employee work scenario.

Additionally, there is something called the direct-incidence effect which is a standard economic assumption that employees bear the full burden of employer-paid taxes through lower wages. (Probably most noticeable in the stagnant mean income for decades now as health insurance rates have risen.

(Probably most noticeable in the stagnant mean income for decades now as health insurance rates have risen.

In fact, employees are even paying out of earnings now to offset the increased health insurance premiums when they used to be included without payroll cost as an expectation of employee benefit.)

So, when employers are faced with a 6.2% increase in taxes in wages, employee income is reduced by that amount. The lower wages then not only reduce the Social Security tax revenue but also directly impact tax revenues for Medicare (Another 24% of the Federal budget).

In fact, they impact all federal, state and local income taxes as well. A snowball rolling downhill and gaining momentum impacting more and more of our economy as all levels of governments lose tax derived income.

While it sounds good on the campaign trail, reality indicates that Bernie’s cap elimination and expansion is not as simple a solution as it sounds.

Bernie makes it sound so inviting and so simple. Instead, if implemented it will:

In short, raising the cap is nothing more than another campaign promise that will not be kept. Or if kept will make things worse not better!

The public who gets suckered in by its simplistic solution will end up, as usual, holding an empty bag.

Hey, like the man’s supporters say- Feel the Burn! (But good!)

Recent Studies Show Canadian Healthcare is Far From Free and Not Getting Better

The “Squad” Nothing More Than Scripted Justice Democrat Puppets

Ever Heard of “Fully Automated Luxury Communism”? Didn’t Think So.

The Bernie Sanders Deception – Feel the Burn – Part 2

Undercover Video By Project Veritas Reveals Deep State Communists Working in Federal Government

Argentina’s Economy Still Struggling to Recover From Years of High Spending and Government Interventionism

Venezuela – A Portrait in the Failure of Socialism

Another Brilliant Progressive Idea from Gavin Newsom- Universal Healthcare for ALL – Including Illegal Immigrants!